Residential Remodelers - Market Size, Financial Statistics, Industry Trends

Industry Overview

This U.S. industry comprises establishments primarily responsible for the remodeling construction (including additions, alterations, reconstruction, maintenance, and repairs) of houses and other residential buildings, single-family and multifamily. Included in this industry are remodeling general contractors, for-sale remodelers, remodeling design-build firms, and remodeling project construction management firms. Cross-References. Establishments primarily engaged in--Source: U.S. Census Bureau

Residential Remodelers Market Size

This report includes historical and forecasted market sizes and industry trends for Residential Remodelers. It reveals overall market dynamics from 2021 through the present, and predicts industry growth or shrinkage through 2031. Revenue data include both public and private companies in the Residential Remodelers industry.| Historical | Forecasted | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | |

| Market Size (Total Revenue) | Included in Report |

||||||||||

| % Growth Rate | |||||||||||

| Number of Companies | |||||||||||

| Total Employees | |||||||||||

| Average Revenue per Company | |||||||||||

| Average Employees per Company | |||||||||||

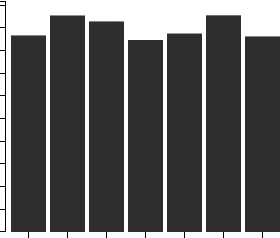

Industry Revenue ($ Billions)

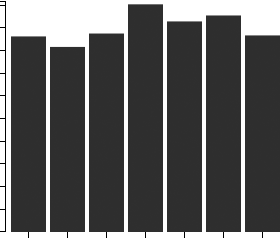

Industry Forecast ($ Billions)

Pell Research's advanced econometric models forecast five years of industry growth based on short- and long-term trend analysis. Market size statistics include revenue generated from all products and services sold within the Residential Remodelers industry.

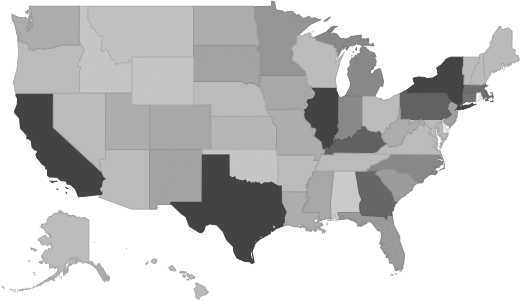

Geographic Breakdown by U.S. State

Residential Remodelers market share by state pinpoints local opportunities based on regional revenue statistics. Growth rate for each state is affected by regional economic conditions. Data by state can be used to locate profitable and nonprofitable locations for Residential Remodelers companies in the United States.Industry Revenue by State

Distribution by Company Size

| Company Size | All Industries | Residential Remodelers |

|---|---|---|

| Small Business (< 5 Employees) | Included |

|

| Small Business (5 - 20) | ||

| Midsized Business (20 - 100) | ||

| Large Business (100 - 500) | ||

| Enterprise (> 500) | ||

Industry Income Statement (Average Financial Metrics)

Financial statement analysis determines averages for the following industry forces:- Cost of goods sold

- Compensation of officers

- Salaries and wages

- Employee benefit programs

- Rent paid

- Advertising and marketing budgets

The report includes a traditional income statement from an "average" Residential Remodelers company (both public and private companies are included).

| Industry Average | Percent of Sales | |

|---|---|---|

| Total Revenue | Included |

|

| Operating Revenue | ||

| Cost of Goods Sold (COGS) | ||

| Gross Profit | ||

| Operating Expenses | ||

| Operating Income | ||

| Non-Operating Income | ||

| Earnings Before Interest and Taxes (EBIT) | ||

| Interest Expense | ||

| Earnings Before Taxes | ||

| Income Tax | ||

| Net Profit | ||

Average Income Statement

Cost of Goods Sold

Salaries, Wages, and Benefits

Rent

Advertising

Depreciation and Amortization

Officer Compensation

Net Income

Financial Ratio Analysis

Financial ratios allow a company's performance to be compared against that of its peers.| Financial Ratio | Industry Average |

|---|---|

| Profitability Ratios | Included |

| Profit Margin | |

| ROE | |

| ROA | |

| Liquidity Ratios | |

| Current Ratio | |

| Quick Ratio | |

| Activity Ratios | |

| Average Collection Period | |

| Asset Turnover Ratio | |

| Receivables Turnover Ratio | |

| Inventory Conversion Ratio |

Compensation and Salary Surveys

Salary information for employees working in the Residential Remodelers industry.| Title | Percent of Workforce | Bottom Quartile | Average (Median) Salary | Upper Quartile |

|---|---|---|---|---|

| Management Occupations | 10% |

Included |

||

| Chief Executives | 0% | |||

| General and Operations Managers | 3% | |||

| Other Management Occupations | 6% | |||

| Construction Managers | 6% | |||

| Construction Managers | 6% | |||

| Office and Administrative Support Occupations | 13% | |||

| Construction and Extraction Occupations | 63% | |||

| Supervisors of Construction and Extraction Workers | 9% | |||

| First-Line Supervisors of Construction Trades and Extraction Workers | 9% | |||

| First-Line Supervisors of Construction Trades and Extraction Workers | 9% | |||

| Construction Trades Workers | 52% | |||

| Carpenters | 28% | |||

| Carpenters | 28% | |||

| Construction Laborers | 16% | |||

| Construction Laborers | 16% | |||

Government Contracts

The federal government spent an annual total of $100,665,932 on the Residential Remodelers industry. It has awarded 995 contracts to 163 companies, with an average value of $617,582 per company.Top Companies in Residential Remodelers and Adjacent Industries

| Company | Address | Revenue ($ Millions) |

|---|---|---|

Included |

||